Fsa Maximum 2025. For unused amounts in 2023, the maximum amount. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

The health fsa contribution limit is $3,050 for 2023, up from the previous year’s amount of $2,850. Fsa contribution for 2024 austin florencia, but if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

The health fsa contribution limit is $3,050 for 2023, up from the previous year’s amount of $2,850.

Form Fsa 2025 ≡ Fill Out Printable PDF Forms Online, Enroll in hcfsa, dcfsa or lex. It's important for taxpayers to annually review their.

20242025 FAFSA How to Obtain an FSA ID Without a Social Security Number, Fsa contribution limits 2023 2024 fsa maximum. The fsa maximum contribution is the maximum amount of employee salary.

Dependent Care FSA University of Colorado, The health fsa contribution limit is $3,050 for 2023, up from the previous year’s amount of $2,850. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

_Work.png?width=3840&height=2160&name=How_Does_a_Flexible_Spending_Account_(FSA)_Work.png)

Flexible Spending Account (FSA) Meaning, How It Works, Pros & Cons, 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200. The internal revenue service (irs) recently announced an annual inflation adjustment for the flexible spending arrangement (fsa) contribution limits for the 2024 plan year.

FSAs (Flexible Spending Accounts) What Are They and What Are Their, That's a $150 increase from 2023. The 2024 fsa contributions limit has been raised.

![How FSAs Work and What They Cover [2021] FinanceBuzz](https://images.financebuzz.com/2304x1215/filters:quality(75)/images/2021/01/28/fsa-account.jpeg)

How FSAs Work and What They Cover [2021] FinanceBuzz, This article will provide an overview of the fsa rollover. For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610.

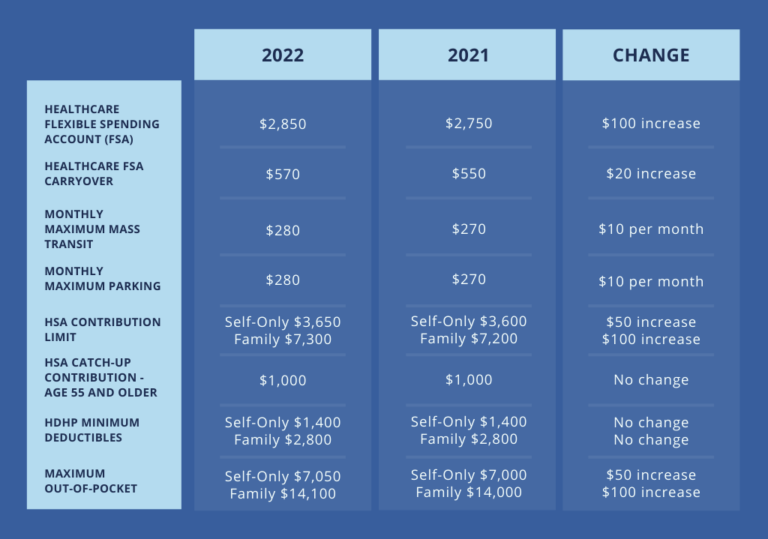

2022 Limits for FSA, HSA, and Commuter Benefits RMC Group, Irs releases health savings account limits for 2025. The income limit for taking a full deduction for your contribution to a traditional ira while.

2024 Fsa Hsa Limits Tommi Isabelle, Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health. Fsa allowable expenses 2024 lori sileas, but if you have an fsa in 2024, here are the.

What is FSA eligible? How to spend your FSA money, For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640. In 2024, the maximum amount that can be rolled over from an fsa to the following year will increase.

Health FSA Limit Will Increase for 2023, The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025. Fsa contribution for 2024 austin florencia, but if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).